Land Value Still Leads in Property Growth: Key to Better Home Returns

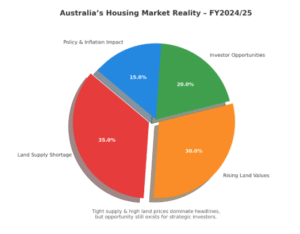

Recent data from the Housing Industry Association (HIA) confirms what many buyers are experiencing on the ground: land prices are surging. In FY2024/25, the national median lot price surged by 6.8%, which was three times faster than inflation. This stark price increase has made land costs the main hurdle in achieving Australia’s 1.2 million homes target, an issue becoming increasingly visible in the property market.

At Buyer Insight, we are seeing this trend play out with clients, both first-home buyers and investors alike. The low supply of land, combined with rising values, presents a real challenge but also new opportunities for those with a plan.

Key Markets are Tightening Fast

- Land prices up sharply. The demand for land-connected options has consistently been higher than the available supply. As a result of this imbalance of consistent demand, the prices for land connected options increased by 6.8% last year. This growth in land price far outpaces general inflation, ensuring that blocks remain expensive.

- Key markets are tightening. Perth lot prices soared by about +30% over 12 months. Brisbane’s lots jumped 9.2%, pushing it past Melbourne for the first time in years. Even Adelaide (usually cheaper) saw typical lot values rise by ~8%. Western Australia, South Australia and Queensland have had more available land (and faster building), but their price advantage is now shrinking.

- Costs remain high. The cumulative build cost increase is around +33% since COVID. And despite recent rate cuts, new home approvals and starts are still 7–9% below long-term averages. In other words, cheaper finance hasn’t fixed the land crunch – builders need more ready land even as borrowing costs ease.

Why Land-Linked Homes Outperform

Rising land prices translate into bigger gains for detached homes. A house comes with a block of land, so it participates in land-driven growth, whereas apartments do not. As finance experts note, “houses usually offer greater long-term capital growth than apartments” because land typically appreciates. In a tight market, that land component really matters: owners of standalone homes should see stronger capital gains.

For first-home buyers and investors today, the message is clear: act early while land is still available. With interest rates fairly stable and no quick fix for supply, now is an ideal window to lock in ground-floor value. Each small rate cut only boosts demand further, so securing a home now can avoid chasing even higher prices later. Well-chosen standalone homes should outperform units as scarce land values keep climbing.

Another factor that increases the stability of land-linked properties is the limited supply of developable land in major urban centres. As the population is increasing and the planning process takes longer, land becomes harder to purchase and increasingly more expensive. This is a consistent and continuous upward pressure on prices for houses that have their own land. Therefore, new apartment buildings, which can be built more easily, typically increase in value at a relatively lower rate over time.

For more guidance and insights, you should partner with professionals like Buyer Insight. If you have questions or are ready to start your search, feel free to call us at +61 4684 4478. You can also book a one-on-one consultation today to get more personalised advice.