House Prices Are Rising: What Buyers Need to Know for 2025–2027

Westpac’s latest forecast shows strong price growth to 2027. In Perth, for example, median house prices could rise by about $134,000 in that time. Sydney’s median is tipped at around $1.7 million, and Canstar finds five of six capitals may exceed $1 million medians by 2027. In short, waiting to buy often means paying significantly more later.

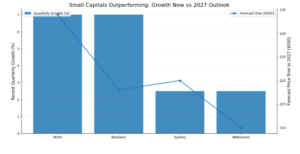

Small capitals are outperforming the big two. As Westpac notes, As Westpac notes, Perth and Brisbane have led recent growth, significantly outpacing Sydney and Melbourne. Those major cities are still rising, but growth is cooling. Strong demand and tight supply in places like Perth and Brisbane mean faster gains there.

What does this mean for buyers?

Timing the market is hard, so focus on strategy. Delaying entry could cost six-figure sums as prices climb. We advise clients to target affordable, high-demand areas. Many regional and outer suburbs still offer better value and rental yields, as inner-city medians push above $1M. Early movers in undersupplied markets get the pick of homes. As one analyst notes, first-home buyers often have to settle for “something smaller, uglier, further away from the CBD” to get on the ladder.

Interest rates and borrowing power also matter. The RBA’s three rate cuts in 2025 boosted an average borrower’s capacity by roughly $35,000. In practice, however, fast-rising prices have already eaten into this benefit. Banks’ mortgage books have grown by tens of billions as buyers and investors return.

Why supply shortages are pushing prices higher

Lack of supply is one of the main drivers for inflation in today’s economy. The shortage of available homes is one of the most significant contributors to the rise in home prices. New home construction has been outpaced by population growth. This has resulted in a shortage of housing in many of Australia’s high-demand areas, such as Perth and Brisbane. Because of this limited availability, there continues to be fierce competition among potential buyers for the small amount of housing available, resulting in rapidly escalating prices. Until the number of homes on the market increases, this competition will continue to drive prices upward, which suggests that now may be a more prudent time to purchase than waiting to see what happens.

Key Takeaways for Buyers:

- Focus on growing areas: Perth and Brisbane are anticipated to experience the highest levels of appreciation. Purchasing a home in these markets that currently have a limited supply will preserve the value of your investment.

- Plan for rising prices: Each year of delay risks adding 5–6 figures to your purchase price. Building a larger deposit today can save you money later.

- Choose your strategy: Location trumps timing. Affordable outer-city and regional markets are accelerating faster than inner-city hotspots. Balance capital growth with rental yield based on your goals.

- Act early: In tight markets, the first buyers have the advantage. A good buyer’s agent can help find value (even in “ugly” or off-market properties), so you aren’t chasing a rapidly rising median.

For ongoing market updates and guidance, we at Buyer’s Insight are always available to help with your purchase strategy. Our services are tailored to each buyer’s needs. You can also connect with us by calling this number, +61 468 444 478 and booking a free consultation with us.

Follow Buyer’s Insight on Instagram and connect on LinkedIn.