Help to Buy Scheme Set to Launch – What Buyers Need to Know

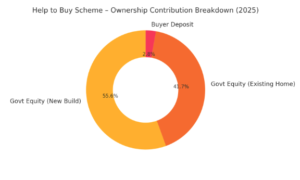

Australia’s long-awaited “Help to Buy” shared-equity scheme opens for applications on 5 December 2025. Under this plan, eligible homebuyers (first-timers and those re-entering the market) can co-purchase a property with the government. Housing Australia will provide up to 30% (for existing homes) or 40% (for new builds) of the purchase price, meaning buyers may need as little as a 2% deposit. The buyer still owns the home, but shares any capital gains or losses with the government. Importantly, the scheme is capped at 10,000 participants per year, so competition for spots will be intense.

Scheme details and limits

Eligible buyers must be Australian citizens earning up to $100,000 (single) or $160,000 (couples/single parents) annually. Properties must meet price caps that vary by location. For example, Sydney buyers can access homes up to $1.3 million, Melbourne up to $950,000, Brisbane/Gold Coast $1 million, Adelaide $900,000, Perth $850,000, Hobart $700,000 and Darwin $600,000abc.net.au. Eligible properties include new or established houses, townhouses, units or duplexes, and even vacant land with a signed building contract. Buyers must have “reasonable” savings, but can have a deposit as low as 2%. The scheme cannot be combined with other government home-buying guarantees or loans, but can be stacked with stamp duty concessions and the First Home Super Saver scheme.

- Low deposit: just 2% minimum requiredtheguardian.com.

- Government stake: up to 40% of a new build, 30% of an existing home.

- Income caps: $100k (single), $160k (joint).

- Price caps: city-dependent (e.g. Sydney $1.3m, Melbourne $0.95m).

- Places: only 10,000 spots per year, nationwide.

Shifts in Demand and Markets

With deposit barriers lower, we expect a shift in first-home-buyer (FHB) demand from apartments to houses. Detached homes in affordable growth corridors will be especially sought-after. As buyers’ agents, we’re watching outer suburbs and regional areas where prices sit under the caps – these could become new hotspots. For instance, families may look further out: suburbs in northwest Sydney, outer Melbourne or regional Queensland where median house prices fit the limits. However, demand will far exceed supply. Research shows roughly 485,000 households could qualify, but only 10,000 places exist. In plain terms, many people will miss out despite qualifying. Buyers must act fast when spots open on 5 Dec.

How a buyer’s agent can help

This is where a professional buyer’s agent brings real value. We will crunch the numbers and research the market to find homes that fit the scheme’s criteria and offer genuine value. Rather than relying on an agent’s guide price, we use recent sales and growth trends to set bids or offers. In many cases, we can even negotiate an off-market deal or submit an offer before auction to secure a property below its maximum value. This keeps our clients out of emotional auction battles. With only 90 days to find a home once approved, our team works quickly: we get buyers pre-approved with one of the initial lenders (CBA or Bank Australia) and then hunt for suitable homes. By aiming for a direct negotiation or carefully timed auction bid, we save our clients time, stress and potentially thousands of dollars in overbidding.

Ready to get started? At Buyer Insight, we guide both first-home buyers and investors through these changes. We’ll help you understand the Help to Buy rules, calculate what you can afford, and negotiate the best deal. Contact our team today to see how the scheme can work for you. Call us at 0468 444 478 or book a free 30-minute consultation.

Follow us on LinkedIn and Instagram for expert property insights, market trends, and real success stories of long-term growth achieved through smart buying strategies!