National House Price Growth Slows: What Buyers Need to Know Now

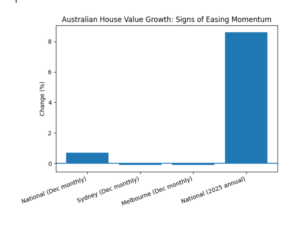

National house values are still rising, but the pace is easing. December’s national growth was just 0.7%, the smallest monthly increase in five months. Overall, 2025 saw a strong 8.6% gain, but even those lofty annual figures hide plateaus in priciest markets. Sydney and Melbourne, for example, each slipped about 0.1% in December. This isn’t a sign that values will collapse, after all, prices have come a long way, but it does show that steeply-priced cities can’t ignore affordability constraints. For buyers, that means being realistic about entry prices and not assuming every slowdown brings a bargain.

Mixed market signals

Across Australia the picture is mixed. Perth and Adelaide posted the strongest gains in December (+1.9% each), while Darwin and Brisbane rose 1.6%. Demand is concentrated in more affordable pockets. Economist Nerida Conisbee notes the expanded 5% deposit scheme is “really accelerating growth” at that price point. In October 2025 the government broadened the Home Guarantee scheme so first-home buyers (and eligible single parents) can purchase with just a 5% deposit. In practice, that means intense competition for sub-$1 million homes in Brisbane, Adelaide and other cheaper markets even as the top-end cities cool.

Borrowing power matters

Even in slowing markets, entry-price discipline is vital. Sydney’s median house price is around $1.5 million, far above the $991,331 median of all capitals and $901,257 nationally. At those levels, many buyers simply can’t qualify without large deposits. New APRA rules now cap high-debt loans: only 20% of new mortgages can exceed six times the borrower’s income. In short, borrowing limits, not just headline prices, will determine what you can afford. If you don’t meet those limits, it’s often wiser to focus on more affordable areas where your budget can secure a home.

Focus on fundamentals

The cooling in some metros highlights that selection matters more than timing. Look for markets with tight supply and steady demand. Conisbee points out “pockets of relatively affordable housing”, Perth, parts of Queensland, Adelaide and even Melbourne apartments, that remain resilient. A buyer’s agent filters hype and prioritises these fundamentals: we match your borrowing power and goals to suburbs where prices fit, rather than chasing headlines. In a subdued market, picking the right property and place will always matter most.

Ready to get started? Buyer Insight provides support to first-time homebuyers and investors during this time of uncertainty. The new lending criteria require you to calculate your real lending capability; however, we help you to compare loan products so you know exactly how to take advantage of the new Home Guarantee Scheme, which allows for a 5% deposit. Contact one of our staff members today at 0468 444 478 or schedule a free 30-minute consultation to discuss your objectives. Follow us on Instagram and LinkedIn for additional information regarding purchasing a home.