Underquoting at Auction: How Buyers’ Agents Level the Playing Field

Real estate price “baiting” where agents list a property below its true value, is still common in Australia. A recent ABC News investigation found multiple Sydney auctions where homes sold 15–31% over their advertised guides. Homeowners described attending these auctions as “demoralising” and “exhausting” when the final price was well beyond their budget. In other words, lowball price guides can lure large crowds and spark bidding wars – a practice ABC calls “price baiting”, which unfairly inflates competition and leaves buyers paying more.

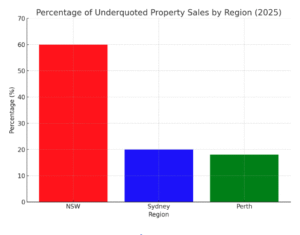

Across the country, underquoting is a widespread issue. Buyer research tools (like KoalaData, now Homer) tracked 220+ listings in 2025 with price guides more than 10% below the final sale price. Nearly 60% of those misleading guides were in New South Wales, but Sydney and Perth are also hotspots (about 20% and 18% of sales, respectively). Major media reports note that even with laws against bait advertising, underquoting remains common in Sydney and Melbourne auctions. In Queensland, agents can’t even give a guide price for auctions at all, showing how seriously states take the problem.

As buyers’ agents, our job is to protect clients from these traps. We start by doing our own homework: checking recent comparable sales, property histories and market data instead of trusting the listed guide. For example, Sydney buyer’s agent Frank Russo told ABC News it’s “highly misleading” and “unethical” for agents to quote low when they know sellers expect much more. We take that to heart by running the numbers on every property. If a listing looks too cheap, we dig deeper. We might open a buying strategy: often, we can approach the seller or the selling agent privately and make a direct offer before auction day, potentially saving our client from an emotional bidding war.

How buyer’s agents protect you:

- Research local data: We use tools like KoalaData and CoreLogic to verify a property’s true market value, not just the advertised guide. (Industry experts say buyers assume underquoting is common – it’s wise to expect that and double-check.)

- Set a clear budget: With a realistic bid range in mind, we help you stick to it. Entering the auction with a firm upper limit (or negotiating outside of the auction) means you won’t get swept up in a “gotta win” frenzy.

- Auction strategy: We’ll often preview auctions or attend similar ones to gauge competition. In many cases, we can make a buyer-agent offer directly, saving time and avoiding auctions that are likely out of reach.

- Leverage transparency: In states like Victoria, agents must now justify their price guides with three recent comparable sales. A buyer’s agent can review those comps and the listing’s “statement of information” to spot any red flags of underquoting.

Regulators are cracking down, too. NSW Fair Trading has launched an $8.4 million taskforce on price baiting, and agents caught underquoting face fines (up to $22,000), loss of commission or license. Consumer Affairs Victoria reports thousands of underquoting complaints: since 2022, its taskforce issued 203 fines (totalling $2.3 million) and hundreds of warnings to agents. (Even if laws vary by state, the trend is clear: buyers need accurate price guides and stronger consumer protection.)

In practice, we advise all buyers – first-home or investors – to treat suspiciously low guides with caution. Verify price ranges by comparing recent sales in that suburb. If a guide seems unrealistically low, ask why: sometimes agents re-post a higher range right after auction, as happened in Burwood (after a 28% overshoot, the guide was later raised by $1 million). Ultimately, engaging a buyer’s agent means you have a professional looking out for your interests. We do the legwork and negotiation so you don’t waste weekends chasing auctions beyond reach.

Ready to bid with confidence? At Buyer Insight, we guide both first-home buyers and investors through every step. We’ll help you set a realistic budget, explore finance options, and connect you with expert buyer’s agents who know the data and the market. Protect your purchase with professional advice – speak to our team today about buying smarter. Call us on 0468 444 478 or book a free 30-minute consultation to get started.