6 Property Market Trends Australian Buyers Need to Know in 2026

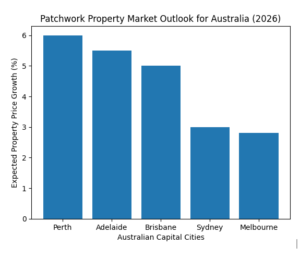

Australia’s property market is expected to keep growing in 2026, but at a slower, patchier pace than last year. Major networks like LJ Hooker forecast that affordable capitals, Perth, Adelaide and Brisbane, will outpace Sydney and Melbourne, where growth has softened. In practical terms, that means buyers will need to zoom in on the right suburbs. What works in Brisbane’s Ripley or Adelaide’s Munno Para might not hold true in inner-city Sydney. Suburb-level research and guidance from a buyer’s agent become crucial in this “patchwork” market.

Interest rates have settled back to a “new normal” and are unlikely to drive big swings in 2026. Instead, price shifts will hinge on supply and demand. The good news is that more homes are expected to come to market, easing some pressure. But housing stock remains tight overall. Most regions will still tilt towards sellers, so buyers should come prepared. That means having finance pre-approval and a clear strategy; timing matters more than ever in a balanced, uneven market.

Why First-Home Buyers Face More Competition in 2026

Renters will continue to outnumber available homes, keeping rents high and drawing investors into the market. For first-home buyers, this means stiff competition in the entry and mid-market segments, where many investors are hunting bargains. A buyer’s agent can help here by pointing clients toward value and quality. Under rising affordability pressures, “value not postcodes” is the mantra: look to up-and-coming suburbs, outer edges of cities or regional hubs where prices are lower but growth prospects are solid. This shift is already underway, for example, first-home buyers are now active in places like Penrith (NSW), Werribee (VIC) and other affordable corridors.

Practical tips for buyers in 2026:

- Focus locally. Filter properties at the suburb level rather than by broad city trends; even within a city, some areas will outperform others.

- Chase value, not prestige. Affordable areas, not necessarily the most famous postcodes, are in demand. Think energy-efficient homes or multi-gen floorplans that appeal to modern buyers.

- Plan for competition. Entry-level homes and mid-priced properties will face the highest demand. Have your loan options sorted in advance and be ready to move quickly on the right home.

- Expect seller-friendly conditions. Even with more listings, sellers still have the upper hand in most markets. Patience is key; don’t rush into bidding wars.

- Stay prepared. High levels of competition remain in the marketplace; therefore, it is recommended that you organise your financial position well in advance. Expert assistance (a buyer’s agent and mortgage broker) is beneficial to the buyer to determine borrowing capability and available loan options prior to the buyer commencing a property search.

With an improved understanding of current buyer trends and market strategies, prospective buyers feel confident about being able to purchase property in 2026. With the ability to gain insight into the market and prepare accordingly, purchasing real estate is still possible.

Ready to get started? We at Buyer Insight want to support you and make you aware of the changing property markets. You can call us on 0468 444 478 or request a free consultation to discuss your situation. You can also follow us on Instagram and LinkedIn for additional tips and updates.