2025 Housing Market Rebound: Growth, Hotspots and Buyer Strategies

Australia’s housing market has rebounded strongly in 2025. National values rose about 1.0% in November and are roughly 8% higher year-on-year. Three straight months of ~1% gains by November lifted the market to a record $12 trillion total value. This rally – fueled by RBA rate cuts, lower inflation and tight supply – defied stretched affordability and flat growth earlier in the year.

Where to Buy Now

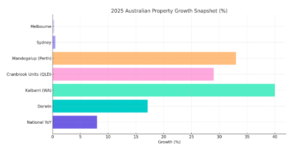

- Mid-size capitals: Perth, Brisbane and Darwin saw the strongest growth (Darwin +17.1% YTD).

- Affordable suburbs: Lower-priced markets are booming. For example, Kalbarri (WA) house values are up +40% and Cranbrook (QLD) units +29%. Fringe Perth areas like Mandogalup jumped ~33%.

- Avoid Sydney/Melbourne hotspots: Sydney (+0.5%) and Melbourne (+0.3%) are near an affordability ceiling. Buyers and investors should instead target affordable cities and regions for better value and yields.

Investor Hotspots

- Rising investor demand: Property investors now account for ~38% of new mortgages, the highest share on record. Many are targeting WA and QLD, where yields are strongest.

- High yields in mining towns: Resource hubs top the charts. Newman (WA) delivers ~12.6% house yields; South Hedland ~17.8% on units.

- Strong rent growth: Towns like Pegs Creek (Karratha, WA) saw house rents jump +23.5%, and Rockhampton (QLD) +21.1% for units. Yields above 10% are common in these areas.

Balancing Affordability and Risk

Cotality data show the median house price is now ~8.2× average income, and about 45% of median income is needed to service a new loan. These record price-to-income and debt burdens mean many buyers face tight budgets. With rates on hold and strict lending tests (20% DTI cap), borrowing power is squeezed. As buyer’s agents, we focus on each client’s capacity and priorities. We recommend lower-priced, high-yield markets to balance portfolios, and we strongly discourage chasing overpriced Sydney/Melbourne suburbs. Our strategy includes running detailed loan and cash-flow scenarios to match clients with suitable properties and debt structures.

Looking Ahead to 2026

We expect growth to be more measured next year. Listings remain ~18% below normal, but higher inflation expectations and stricter credit will limit demand. Citing Cotality’s outlook, the existing supply/demand imbalance alone won’t deliver 2025-style gains. Instead, smart buyers should pick markets with room to grow – typically entry-level segments with tight supply. Lower-value markets should continue to outperform higher-end markets. In short, it’s about selectivity over speculation– focusing on fundamentals like price, yield and borrowing power, not hype.

Ready to get started? At Buyer Insight, we guide first-time buyers and investors through these changes. We’ll calculate your borrowing power, compare home loan options, and ensure your goals are met. Call us on 0468 444 478 or book a free 30-minute consultation. Follow us on Instagram and LinkedIn for the latest property insights and tips.